The last Monetary Policy Committee (MPC) for 2023 has not done anything substantive on the policy front per se. The policy rate continues to be 6.5% and the policy stance remains focused on the withdrawal of accommodation. Sure, there is some dialling back on the liquidity tightening front but the net effect, given the central bank’s pre-policy squeeze on various kinds of lending, might not be very big.

Does this make the MPC meeting just another point in the policy pause continuum in the second half of this year? Far from it.

What is remarkable about the MPC resolution is its bullish stance on the Indian economy’s growth prospects. The MPC’s upward revision in 2023-24 growth projection to 7% from the October forecast of 6.5% also includes higher growth projections for the December 2023 and March 2024 quarters. Even for the first three quarters of 2024-25, GDP growth is in the 6.5% range. These projections suggest the MPC is confident about the prospects of the Indian economy for the next year or so.

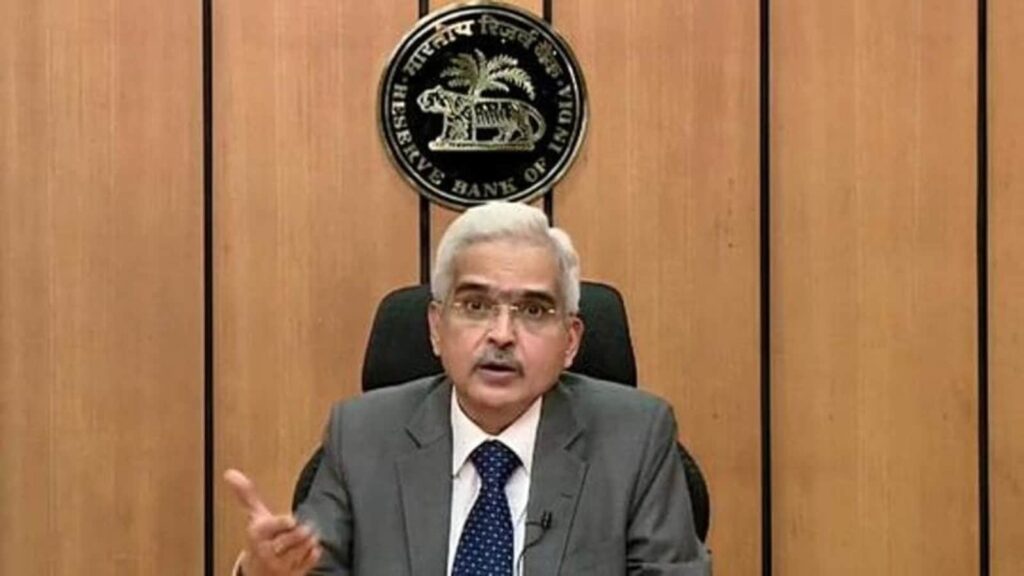

That this prognosis comes at a time when growth continues to be driven by government consumption and investment and private demand is yet to find a sustainable momentum is interesting, to say the least. Sure, RBI has listed possible downsides to growth such as bad winter crop or external headwinds. But what these growth projections and RBI’s tone around monetary policy show is that the central bank sees a stable and committed inflation targeting/financial sector stability messaging as the crucial factor to even short-term growth prospects. Governor Shaktikanta Das’s statement, “Prudence at all times should be the guiding philosophy, both for the regulators and the regulated entities”, reflects this sentiment. India’s experience of the twin balance sheet crisis and recent concerns about what could potentially be subprime lending outside the banking sector justifies this proactive approach.

The only thing that economic policy will have to keep an eye on is the question of demand from the non-rich segment of the economy. This might not matter for the economy growing at 6.5% but unless this engine starts firing, India will not be able to achieve higher growth rates necessary to lift per capita incomes.